Due Date to File Form W2 for 2023 Tax Year

What is Form W2?

Why filing Form W-2 electronically is a preferred method for employees?

The entire process of electronic filing gets done in just a few minutes.

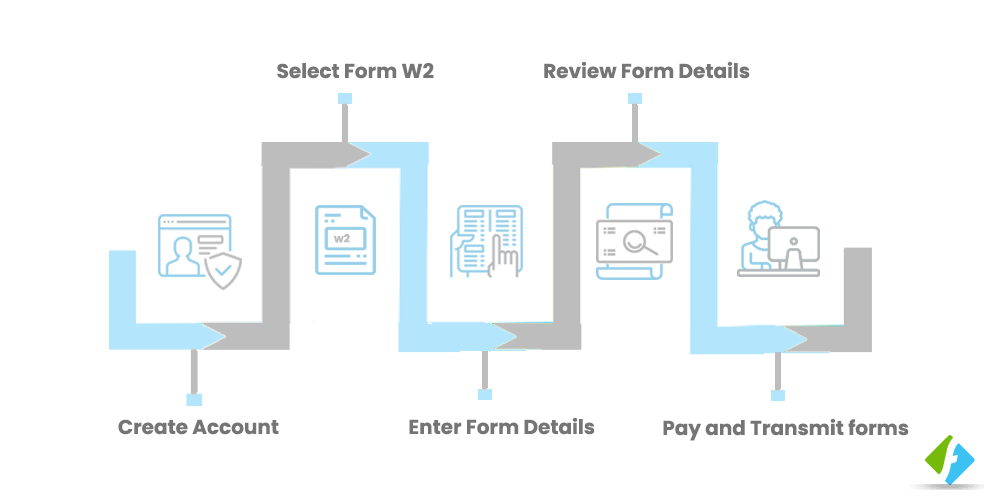

An easy to use software to E-file Form W-2

Our software simplifies e-filing of Form W2 by offering an easy-to-use straightforward filing experience with a step by step process and helpful tips. We also support the e-filing of all the employment tax forms such as Form 941,940,944, Form 1099 (MISC, INT, DIV, R, S, B), and Form 1095-B/C that you are responsible to file for. Just choose the required 1099 tax form and file it directly with the IRS.

Our Software will make you filing stress-free with these time-efficient features:

Direct State Filings

Some states mandate employers to file W-2 forms for the respective state even if they have filed their Form w2 with the Federal. Further, some state additionally require employers to attach the Annual Reconciliation and Transmittal Form along with the Form w2 online . With our software your Form W-2 will be transmitted to the respective state along with the required annual reconciliation and transmittal form.

Print & Postal Mailing

Employers have the responsibility of issuing the copies of W2 forms to their employees. We take care of this process with our print and postal mailing feature. We will have your Form copies to print & postal mail it to your employees on-time. All you have to do is to select the print & postal mail option once you have completed your form information.

Bulk Upload

Do you have more employees to report with or Are you a tax pro having multiple employers to report their W2s? You can just upload all your employee/employer information at once with our Excel template, or use your own template with the same column headings that match our template and file all your W2 forms online instantly.

TIN Matching

Never worry about TIN errors. We validate your employees’ TIN to reduce the chance of TIN errors in your filing. Our system notifies you for any TIN mismatches and we allow you to correct the TIN and retransmit it with the SSA.

Online Access Portal

Your employees can access their Form W-2 copies through a secure online portal. They can view or download their copies anywhere, anytime. They will be notified even if you reported any correction on their Form W-2.

W-2 Form Corrections

Have you made mistake on your previous w2 form? If so you can easily correct & transmit it again with our software. While filing with our software the transmittal Form W-3c is automatically generated. Also we will print & postal mail the corrected copies to your employees.

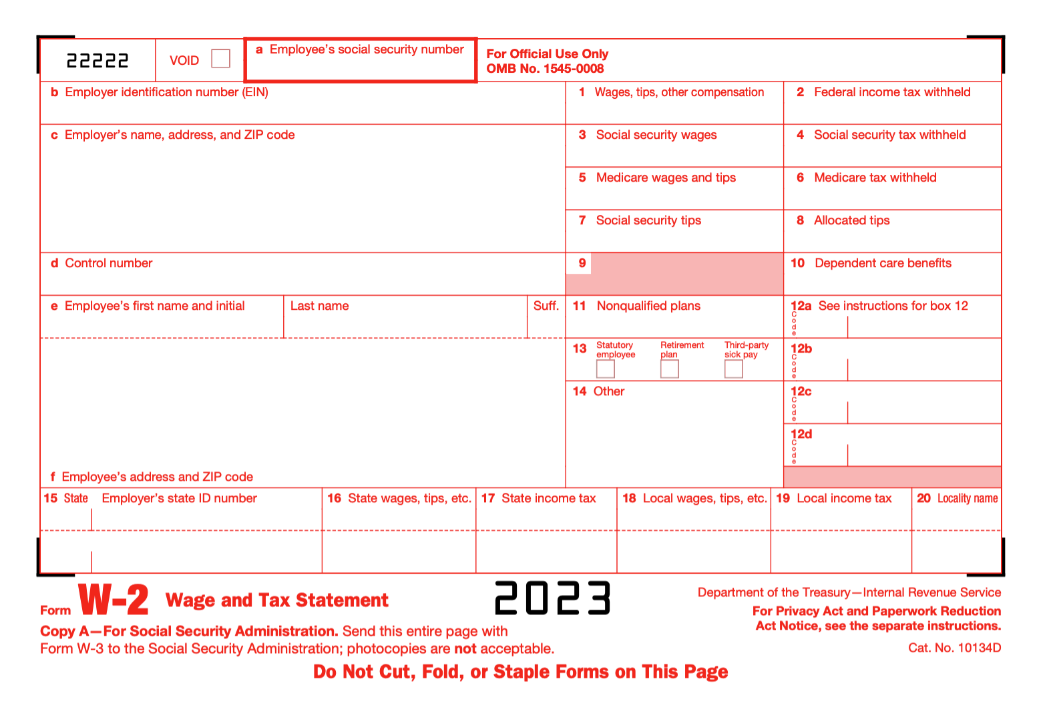

What Information Required to File Form W2 Online?

File Wage Tax Returns in Minutes!

How to File Form 2023 W-2 Online with our E-filing Software?

Helpful Resources for Filing Form W-2 Online

What is Form W-2?

Learn More

Form W-2 Due date

Learn More

Form W-2 Instructions

Learn More

Form W-2 Penalties

Learn MoreForm W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.

Contact Us

We are ready to assist you! Contact our US-based support team located in Rock Hill, South Carolina by phone, email.